Disclaimer: Extreme bearish attitudes can get more extreme, and we now seem in a market where the overshoots occur to the downside and not up. If we are truly on the cusp of a recession or some credit-market “accident,” then the skeptical attitudes will be less a contrarian signal than an appropriate reflection of further downside risk.

So an abundance of investors looking on the dim side of things doesn’t in itself mean the Dec. 24 low in the S&P 500 below 2350 will prove a durable bottom, or that the 8 percent rally from those depths through Friday’s 3-percent pop is the start of a run anywhere near the old highs above 2900.

But fear is fuel for rallies, and the tank was so full after December that plenty more could be burned off in the form of further gains — even if the news doesn’t get noticeably better.

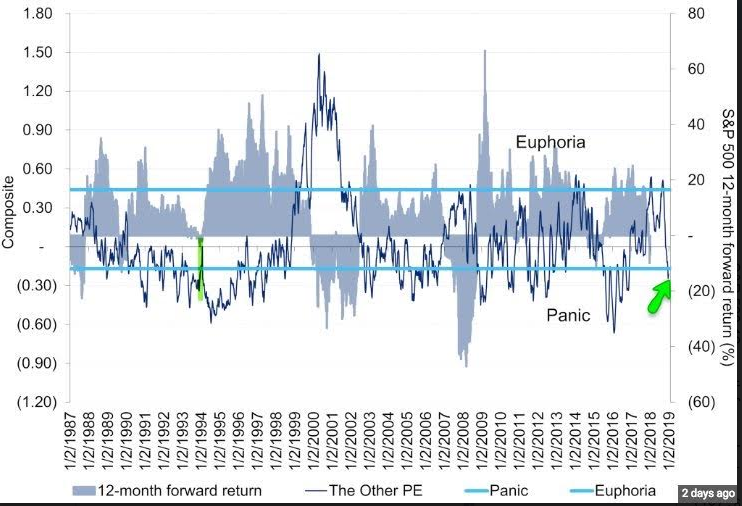

The Citi Panic-Euphoria Index — a composite of technical, survey and fund-flow trends — cracked into Panic territory last week. When in this zone, it doesn’t mean a market low has been set, but 12 months ahead S&P 500 returns have almost always been positive.:

The long-running Consensus Inc, weekly gauge of professional sentiment has rushed to the bearish side of the boat, at levels last seen in 2011 — though not yet matching the farthest extremes from the 2011 sovereign-debt panic:

Deutsche Bank calculates that long-short equity hedge funds have their lowest overall market exposure since 2011, having been chased out of positions in December.

Individuals in December purged a record $86 billion from global equity mutual funds and ETFs — further evidence of loss of faith in the market.

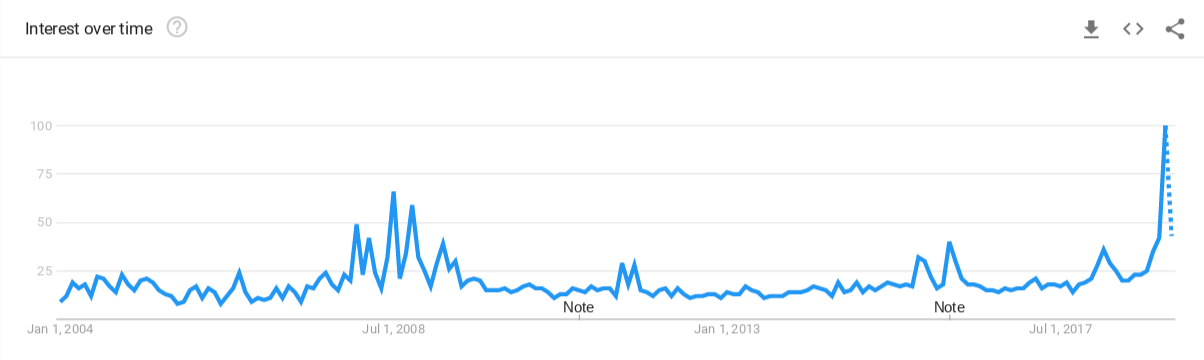

Web surfers have been busily searching for information on bear markets — whether the definition of one or how they behave or how to hide from one.

Google search frequency for “bear market.”:

On a more impressionistic level, last Thursday saw a saturating volume and intensity of bad news and negative extrapolation of scary trends. Apple’s clanging sales warning confirmed investors worst fears about the once-largest stock in the world. The jarring drop in the ISM manufacturing index followed ugly industrial data in China, whipping up recession predictions and spurring a near buying panic in Treasuries, as the 10-year yield sank below 2.6 percent and the yield curve flattened hard.

from Viral News Reports http://bit.ly/2Vz9BQw

0 Comments